Winning at point of sale

Shoppers make decisions on what products to buy at the supermarket based on a number of factors that traditional economic theory and even recent marketing practices have not necessarily fully understood.

In a recent presentation for the British Brands Group at the Museum of Brands, independent consultant Tony Durham described how shoppers make their decisions, how brands are challenged by competing ‘private label’ retailer products and outright parasitic copying (where products adopt packaging designs that mimic the familiar brand), and what techniques brands can use in packaging, marketing and at the point of sale to help attract shoppers’ attention and encourage them to buy their products.

Understanding how shoppers make decisions

Under classic economic theory of decision making, people recognise that they have a particular need. They search for and evaluate the available alternatives and then choose what to purchase. They then go over the outcome afterwards to check whether they made the right decision.

In fact, “most decisions don’t involve deep thought,” says Durham. Only 19% of shoppers in Europe have a shopping list, either written down or in their mind,  meaning that 81% of shoppers rely on colours and shapes of brands to remind them what they need. People typically make decisions on the spot about which products to buy, and such decisions often are not based on comprehensive information or even logic but on information that is instantly available to them. This is memory of a brand’s equity and whatever information is in front of them at the time of purchase.

meaning that 81% of shoppers rely on colours and shapes of brands to remind them what they need. People typically make decisions on the spot about which products to buy, and such decisions often are not based on comprehensive information or even logic but on information that is instantly available to them. This is memory of a brand’s equity and whatever information is in front of them at the time of purchase.

Durham described several characteristics of how people think and make decisions that are important for brand owners to consider when developing their branding, packaging and marketing:

- Force of habit. “There’s an idea that shoppers know what they’re doing. Totally untrue,” says Durham. “The majority of what a shopper does is just routine behaviour, repeat what they did last time, very little thought. It’s mostly on autopilot.”

- Limited attention. Research on consumer ‘eye tracking’ across 44 different categories of products in a major UK store found that people only looked at 8% and only considered buying 3% of the products on the shelves (source: https://www.tobiipro.com). In Durham’s words, “You have a 97% chance your brand will not be seen and will not be considered in the store.” Shoppers are overwhelmed with the amount of information they are bombarded with.

- Limited field of vision. People’s eyes can only focus on a relatively small area, given that our best, full-colour and most detailed vision (‘foveal vision’) is limited to 1 – 2 degrees at the centre of the eye.

- Limited multi-tasking. The brain can typically focus on no more than five things at one time, and therefore has a set of rules that govern where it focuses its limited attention.

- Familiar, different, ‘dangerous’. The brain quickly processes colours and shapes that it knows already. It also focuses on things that are different or ‘dangerous’.

Competing with private-label and parasitic-copy products

In competing for the shopper’s attention at the point of sale, brands owners’ products also must compete against private-label products and sometimes even downright parasitic copying of the shape or other details of the brand’s own products.

“Why does parasitic copying work?” asks Durham. “It works because it mimics the limited visual images in the long-term memory. The brain is looking for colour and shape, and it takes the copy’s colour and shape and sucks them into the same selection set as the branded product: ‘I’m looking for red stuff because I’m looking for Coke, that product is red as well, it’s probably Coke.’ The brain doesn’t put in the effort to tell the difference.”

The UK Intellectual Property Office in 2013 called this the ‘look-alike effect’. Shoppers are more likely to make a mistake in purchasing if the packaging is similar. There is strong evidence that lots of shoppers have made such mistakes, says Durham. The more similar the packaging, the more people think it’s from the same source.

Making a difference in promoting branded products

So what can brands do at the point of sale and in their long-term brand building to help gain shoppers’ attention and convince them to buy their products? Durham described several ways to highlight their differences and get noticed, all rooted in the same idea of controlling the comparison:

- Not just price comparison. The only thing that private-label and copycatting products want shoppers to compare is price, says Durham. A small price difference may not have a great impact but brands need to highlight quality and other product benefits to change the discussion from being exclusively about price.

- Colour, size, shape, positioning. These are the primary things that shoppers typically use to find the products they want. So Nivea, for example, has used a blue circle with its brand name written in w

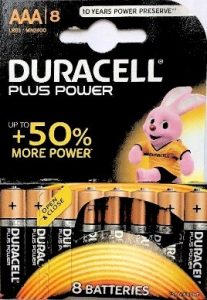

hite for 100 years. A larger and uniquely shaped product feature—such as the red colour and recognisable shape of the Heinz Ketchup bottle—has more impact than several smaller features. A larger font gets more attention than a smaller font. The large-font message “up to 50% MORE POWER” on Duracell battery packaging catches consumer attention and focusses shopper attention on why they should choose Duracell and not risk private label. Such information on shelf-ready packaging and in-store price labels, as well as a good location in-store, can also promote consumer attention to focus on more than just price.

hite for 100 years. A larger and uniquely shaped product feature—such as the red colour and recognisable shape of the Heinz Ketchup bottle—has more impact than several smaller features. A larger font gets more attention than a smaller font. The large-font message “up to 50% MORE POWER” on Duracell battery packaging catches consumer attention and focusses shopper attention on why they should choose Duracell and not risk private label. Such information on shelf-ready packaging and in-store price labels, as well as a good location in-store, can also promote consumer attention to focus on more than just price.

- Product innovation. The more a brand can highlight major or minor innovations in its products, the better these appear to a shopper comparing them with other products. For example, TePe has promoted its interdental toothbrushes as helping to remove “40% more plaque” than traditional toothbrushes and because of this superior performance it is “recommended by 98% of dental hygienists” so why would you choose a private label copy?

- Perceived quality. Fairy Liquid’s “50% more grease cutting than the next best competitor” highlights a major quality metric that helps capture shoppers’ attention at the point of sale and explains why buying private label may not be the brightest idea.

- Awards and recommendations. Reputable third-party endorsements for a product also catch attention, whether that is a recommendation from the British Skin Foundation for washing products like Comfort and Persil, a ‘Product of the Year’ award or a good review or rating from Which? or Good Housekeeping.

- Social proof. Shoppers pay attention to whether products are popular with other people. Nescafé’s claim to be the ‘UK’s favourite coffee’ encourages a shopper to buy the product, says Durham, because people think “if I use that one, my friends are going to keep coming around to coffee, whereas if I buy the store brand, I’m not so sure they will.”

- Money-back guarantee. Adding a money-back guarantee can help remove worries over risks and product quality and can increase purchase intent by 8-10%. It re-assures shoppers that the brand will deliver more than private label.

- Advertising exposure. Advertising can either be at a high level when a brand has new initiatives or can be carried out at a consistent level over time. There is a correlation between exposure and a shopper liking your product.

- Ongoing, consistent brand equity and messaging across all ‘touch points’. “Seamless marketing and advertising works,” says Durham. “What do you think your brand is going to ‘own’? The more you show it to people, the more you should keep it the same. Advertise and package the product and promote it online always in the same colour and font. Otherwise, less people will remember it, it won’t stick in their minds, you won’t build long-term memory for it, the shopper’s brain won’t use it to make decisions and you will lose in-store.”

If a brand is to compete successfully against a retailer’s private label products, where the retailer controls the environment where both products are sold, it needs to get attention, demonstrate reasons for buying and make it easy for shoppers to make decisions to buy their products. That is how brands will ensure that shoppers make a fair comparison against private label on more than just price.

Click here to email this to a friend, or share via using the social buttons below: